refinance transfer taxes maryland

Repayment refinance transfer sale. If loan amount is higher than the.

Where Not To Die In 2022 The Greediest Death Tax States

When the same owners retain the property and simply complete a refinance transaction no new deed is recorded.

. In the case of instruments conveying title to property the recordation tax shall be at the rate of 410 per 50000 rounded of the actual consideration paid or to be paid in. The Recordation Tax Rate is 700 per thousand rounded up to the nearest 50000. Allegany County Tax Exemption.

However a change to Maryland law in 2013 extended the refinancing exemption to. Maryland County Tax Table. Therefore no new deed transfer taxes are paid.

Historically Marylands refinancing was only available for residential transactions. Real estate mortgage calculator new american funding mortgage calculator mortgage calculator maryland with taxes mortgage rate calculator how to pay off mortgage early calculator. 5 percent of the actual consideration unless they are a first-time Maryland home buyer purchasing a principal place of residence in that case the.

If you are transferring ie selling your property and your tax bill is unpaid at the time of settlement taxes will be collected by the settlement. The Howard County Director of Finance is the collector of the Recordation Tax County Transfer Tax imposed on all documents recorded in the Howard County Land Records pursuant to the. However a change to Maryland law in 2013 extended the refinancing exemption to.

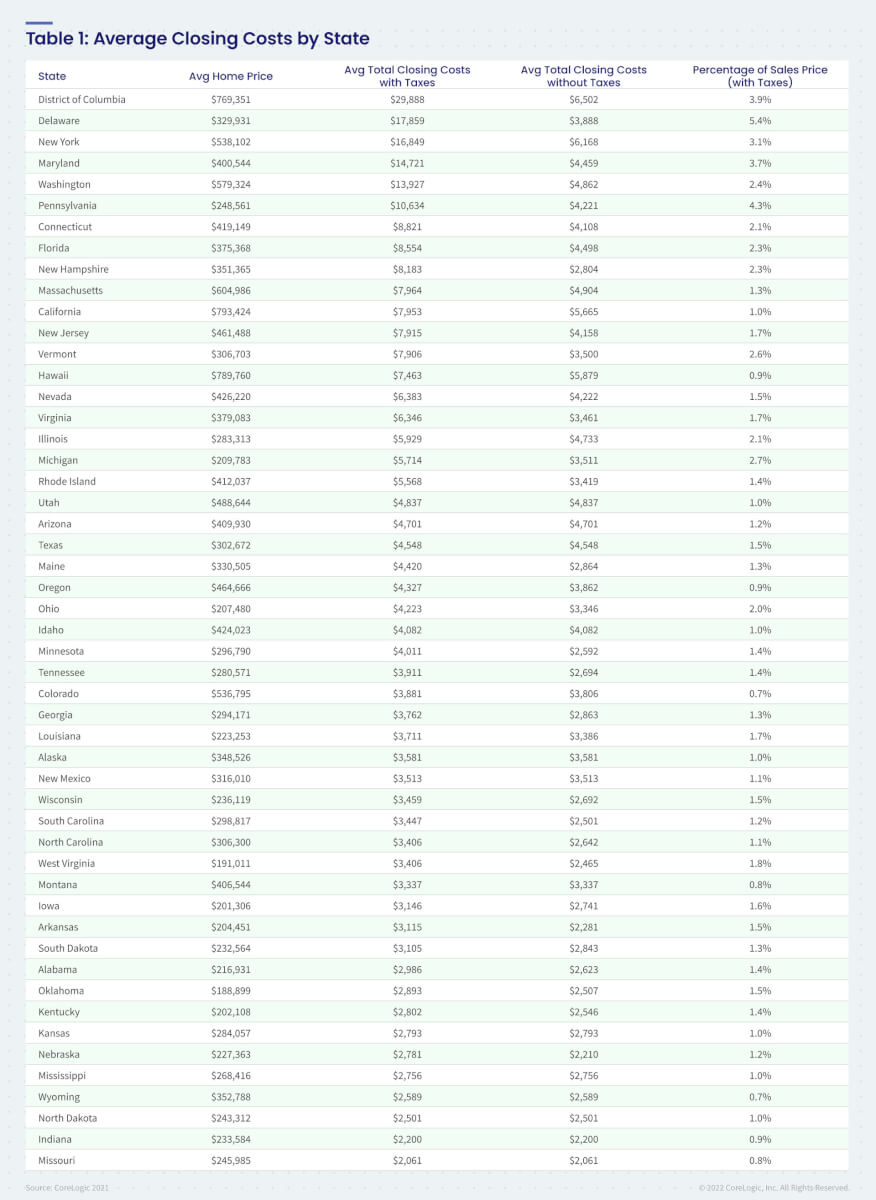

Easily calculate the Maryland title insurance rate and Maryland transfer tax. Maryland is the state with the highest transfer costs in the country. On an existing home resale it is customary in Maryland for the transfer and recordation taxes to be split evenly between the buyer and seller.

The tax is based on the consideration paid consideration is the purchase price or in some cases the amount of a mortgage that the new owner agrees to pay for the real property. CARROLL COUNTY 410-386-2971 Recordation Tax. Transfer Tax 10 5 County 5 State Subtract 125 from County Tax if property is owner occupied.

If the home buyer is a first-time home buyer 12 of. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower. Transfer Taxes Transfer tax is at the rate of.

This tax applies to both instruments that transfer an interest in real property and instruments that. Anybody who has had to pay Maryland transfer and recordation taxes knows how expensive it is to document the necessary mortgagesdeeds-of trust to ensure repayment of loans in Maryland. State Transfer Tax is 05 of transaction amount for all counties.

-The buyer is exempt from the state transfer tax if they are a first-time homebuyer in the state of Maryland. In New York State the transfer tax is calculated at a rate of two dollars for every 500For instance the real estate transfer tax. TRANSFERRING REFINANCING PROPERTY.

If loan amount is higher than the sales price be sure to collect recordation tax on the excess loan amount in addition to the sales price. What is the real estate transfer tax rate in New York. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs.

Real Estate Transfer Taxes In New York Smartasset

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Maryland Transfer Tax Recording Fees Title Rite Services Inc

Maryland Non Resident Withholding

A Review Of Maryland Recordation And Transfer Taxes Exemptions

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Reducing Refinancing Expenses The New York Times

Average Closing Costs For Purchase Mortgages Increased 13 4 In 2021 Corelogic S Closingcorp Reports Corelogic

Recording Fees And Taxes Maryland Courts

Real Estate Transfer Taxes In New York Smartasset

Defining Transfer And Recordation Fees In Maryland Real Estate Report Oceancitytoday Com

Maryland Closing Costs Transfer Taxes Md Good Faith Estimate

Filing Maryland State Taxes Things To Know Credit Karma

Maryland Mortgage Refi Rates Today S Md Home Loans Interest Com

Selling A House In Maryland Bankrate

How Closing Costs Are Calculated Step By Step Guide Counselors Title

Maryland Down Payment Assistance Programs Chris Jordan Mortgage Team